Introduction:

In the ever-evolving landscape of cryptocurrency, Bitcoin reigns supreme as the pioneer and the most prominent digital currency. Central to its design is Bitcoin halving, an event that captivates the attention of investors, enthusiasts, and industry experts alike. But what exactly is Bitcoin halving? Why does it matter? And how does it impact the broader crypto ecosystem?

What is halving meaning?

In Bitcoin and other cryptocurrencies, a halving refers to the event where the reward for mining new blocks is cut in half. This reduction occurs approximately every four years for Bitcoin and is pre-programmed into the cryptocurrency’s protocol. A halving aims to control the rate at which new coins are created and introduced into circulation, striving to maintain scarcity and prevent inflation. This event is significant because it affects the supply dynamics of the cryptocurrency and can influence its price, as it impacts the balance between supply and demand.

What is Bitcoin Halving and why it is important?

Bitcoin halving, also known as the “halvening,” is a predetermined event coded into the fabric of Bitcoin’s protocol. It occurs approximately every four years or after every 210,000 blocks mined. During this event, miners’ block reward for validating transactions on the Bitcoin network is slashed in half. This reduction effectively decreases the rate at which new Bitcoins are generated, making the digital asset scarcer over time.

The importance of Bitcoin halving stems from several factors:

- Scarcity: By reducing the rate of new bitcoin issuance, halving events contribute to increasing bitcoin scarcity over time. This scarcity is a fundamental aspect of Bitcoin’s design and is often likened to precious metals like gold, which are also limited in supply.

- Inflation Control: Bitcoin halving is a built-in mechanism to control inflation within the Bitcoin ecosystem. By periodically reducing the supply growth rate, Bitcoin’s monetary policy mimics that of deflationary assets, where the currency’s value tends to increase over time.

- Market Dynamics: Halving events have historically been associated with significant price movements in the Bitcoin market. The anticipation of reduced supply and ongoing demand often leads to increased speculation and volatility in Bitcoin’s price. This can impact the investment strategies of both individual and institutional investors.

- Network Security: Bitcoin mining plays a crucial role in maintaining the security and decentralization of the Bitcoin network. By incentivizing miners with block rewards, halving events influence the profitability of mining operations and can affect the distribution of hash power across the network.

The Mechanism Behind Bitcoin Halving:

At the genesis of Bitcoin, Satoshi Nakamoto, the pseudonymous creator, devised a deflationary monetary policy to mimic the scarcity of precious metals like gold. By halving the block reward at regular intervals, Bitcoin’s issuance rate follows a predictable and diminishing trajectory. This mechanism shields against inflation and endows Bitcoin with intrinsic value and rarity, akin to digital gold.

Bitcoin Halving History:

The inaugural Bitcoin halving occurred in November 2012, followed by subsequent events in July 2016 and May 2020. Each halving event has historically catalyzed a surge in media attention, market speculation, and price volatility. The anticipation of diminished supply and escalating demand frequently ignites bullish sentiment, propelling Bitcoin’s value to fresh pinnacles.

Bitcoin Halving Dates:

- First Bitcoin halving: November 28, 2012

- Second Bitcoin halving: July 9, 2016

- Third Bitcoin halving: May 11, 2020

The first Bitcoin halving occurred on November 28, 2012, marking a significant milestone in the cryptocurrency’s history. This event reduced the mining reward from 50 BTC per block to 25 BTC per block, cutting the new Bitcoin creation rate in half. It was a momentous occasion highlighting Bitcoin’s deflationary nature and unique monetary policy, setting a precedent for future halving events.

Four years later, on July 9, 2016, the second Bitcoin halving took place. This event further diminished the mining reward from 25 BTC per block to 12.5 BTC per block. The anticipation leading up to the halving fueled discussions and debates within the cryptocurrency community, with many speculating on its potential impact on Bitcoin’s price and network dynamics. Following the event, Bitcoin continued gaining traction in mainstream awareness and adoption.

Lastly, on May 11, 2020, the third Bitcoin halving occurred. Amidst global economic uncertainty and heightened interest in cryptocurrencies, investors, traders, and enthusiasts worldwide watched this halving event closely. With the mining reward reduced to 6.25 BTC per block, the event once again underscored Bitcoin’s scarcity and its role as a hedge against traditional financial systems. Each halving event serves as a reminder of Bitcoin’s decentralized nature and immutable protocol, reinforcing its position as a pioneering digital asset in finance.

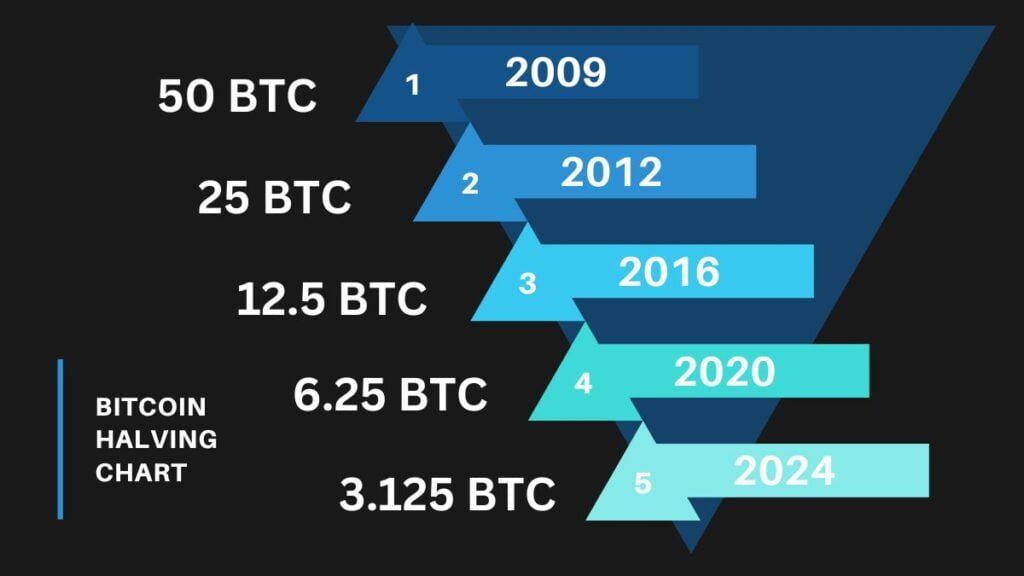

Bitcoin Halving Chart:

As shown below, the Bitcoin halving cycle, recurring every four years, reduces mining rewards to maintain scarcity and control inflation. This event shapes market dynamics, emphasizing Bitcoin’s deflationary nature and value as a digital asset.

Impact on Miners and Mining Economics:

Bitcoin mining, the process by which new Bitcoins are minted and transactions are validated, forms the network’s security and decentralization backbone. Following a halving event, miners experience a direct impact on their profitability. With reduced block rewards, miners must adapt by refining their operations, upgrading hardware, or modifying transaction fees to sustain profitability.

Market Response and Price Dynamics:

The correlation between Bitcoin halving and price dynamics is a topic of intense scrutiny and conjecture. Although past performance does not foreshadow future outcomes, historical data intimates a connection between halving events and bull cycles. The reduction in supply juxtaposed with sustained demand frequently triggers a supply-demand asymmetry, culminating in upward price momentum.

Investor Sentiment and Speculation:

Bitcoin halving events serve as catalysts for investor sentiment and market speculation. The prospect of a dwindling supply narrative and the potential for exponential price appreciation lure institutional and retail investors into the market. This influx of capital and attention further validates Bitcoin’s position as a legitimate store of value and a hedge against fiat inflation.

The Future of Bitcoin Halving:

As Bitcoin continues to mature and gain mainstream adoption, the significance of halving events is likely to amplify. With each successive halving, the remaining supply of new Bitcoins diminishes, approaching the fixed cap of 21 million coins. This inherent scarcity underscores Bitcoin’s value proposition as a deflationary asset and a hedge against monetary uncertainty.

Conclusion:

In conclusion, Bitcoin’s halving is a pivotal event that underscores the economic principles and technological innovations underpinning the world’s leading cryptocurrency. From its inception to its foreseeable future, the halving mechanism shapes Bitcoin’s monetary policy, market dynamics, and investor sentiment. As we navigate the complexities of the digital economy, understanding Bitcoin halving is paramount for anyone seeking to grasp the intricacies of the blockchain revolution.

Frequently Asked Questions (FAQs):

- When is Bitcoin halving in 2024?

- Bitcoin halving in 2024 is projected to occur after 10 days. As per Bitcoin’s protocol, halving events typically occur every four years or after every 210,000 blocks mined.

- When is the next Bitcoin halving?

- The next Bitcoin halving is anticipated to take place in 2028. Following the halving that will occur in 2024, Bitcoin’s protocol dictates that the next halving event will occur approximately four years later.

- When was the last Bitcoin halving?

- The last Bitcoin halving took place on May 11, 2020. During this event, the block reward for miners was reduced from 12.5 to 6.25 Bitcoins per block.

- What is Bitcoin halving dates history?

- The historical Bitcoin halving dates are as follows:

- November 28, 2012: First halving, reducing block reward from 50 to 25 Bitcoins.

- July 9, 2016: Second halving, reducing block reward from 25 to 12.5 Bitcoins.

- May 11, 2020: Third halving, reducing block reward from 12.5 to 6.25 Bitcoins.

- The historical Bitcoin halving dates are as follows:

- What day is Bitcoin halving?

- Bitcoin halving events is estimated to occur on 19 April 2024. However, past halving events have occurred in November 2012, July 2016, and May 2020.

- Is Bitcoin halving good or bad?

- The impact of Bitcoin halving is subjective and depends on various factors. Some view it positively as it reduces the rate of new Bitcoin issuance, thus potentially increasing scarcity and value. Others may perceive it negatively due to the potential impact on miner profitability or short-term market volatility.

- What is Bitcoin halving countdown?

- The Bitcoin halving countdown refers to the time remaining until the next halving event. Various websites and tools provide countdown timers that track the approximate time until the next halving, informing users about the upcoming event and its potential implications.